India’s Adani Enterprises tanks after founder’s US charges

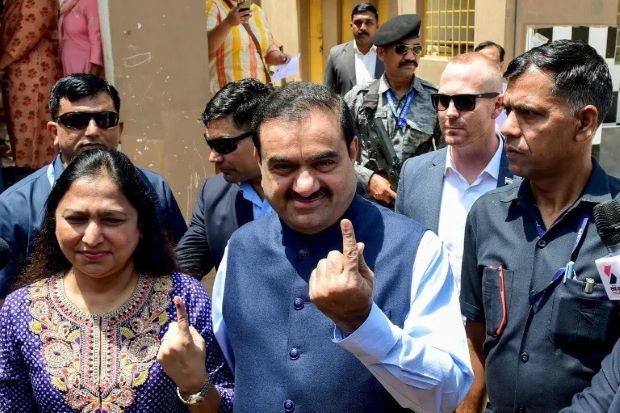

MUMBAI – Shares in India’s Adani Enterprises slumped 20% at Thursday’s (21) open after US prosecutors charged billionaire industrialist founder Gautam Adani with paying hundreds of millions of dollars in bribes and hiding the payments from investors.

The steep losses in the Adani group’s main listed entity were matched by abrupt sell-offs and trading halts in its other publicly traded businesses, with Adani Power losing 11% and Adani Energy Solutions tanking 20%.

The conglomerate’s founder, a close ally of Hindu nationalist Prime Minister Narendra Modi who was at one point the world’s second-richest man, is alleged to have agreed to pay more than $250 million in bribes to Indian officials for lucrative solar energy supply contracts.

The deals were projected to generate more than $2 billion in profits after tax over roughly 20 years.

None of the multiple defendants in the case, including Adani, are in custody.

A statement from Adani Group’s renewable energy subsidiary acknowledged the charges against Adani and two other board members in a brief statement.

Adani Green Energy said it had decided to halt a planned bond sale “in light of these developments”, but did not offer further comment on the allegations.

Founder Gautam and two other board members are accused in the indictment of orchestrating “an elaborate scheme to bribe Indian government officials to secure contracts worth billions of dollars”, US attorney Breon Peace said in a statement.

The trio “lied about the bribery scheme as they sought to raise capital from US and international investors”, he added.

With a business empire spanning coal, airports, cement and media, the Adani Group has weathered previous corporate fraud allegations and suffered a similar stock crash last year.

The conglomerate saw $150 billion wiped from its market value in 2023 after a bombshell report by short-seller Hindenburg Research accused it of “brazen” corporate fraud.

It claimed Adani Group had engaged in a “stock manipulation and accounting fraud scheme over the course of decades”.

The report also said a pattern of “government leniency towards the group” stretching back decades, had left investors, journalists, citizens and politicians unwilling to challenge its conduct “for fear of reprisal”.

Gautam Adani, the family-run conglomerate’s founder, denied Hindenburg’s original allegations and called its report a “deliberate attempt” to damage its image for the benefit of short-sellers.

He saw his net worth shrink by around $60 billion in the two weeks following the release of the report and he is currently ranked by Forbes as the world’s 25th-richest person.

– ‘Abject failure’ –

Adani is considered a close associate of Prime Minister Modi, and opposition parties and other critics have long claimed their relationship helped him to unfairly win business and avoid proper oversight.

Adani Group’s rapid expansion into capital-intensive businesses has also raised alarms in the past, with Fitch subsidiary and market researcher CreditSights warning in 2022 that it was “deeply over-leveraged.”

Jairam Ramesh, of India’s key opposition Congress Party, said Thursday that the indictment “vindicates” their demand for a parliamentary inquiry into Adani.

Ramesh condemned what he called the “abject failure” of the Securities and Exchange Board of India (SEBI) to hold the Adani Group “to account for the source of its investments”.

Adani, born to a middle-class family in Ahmedabad, Gujarat state, dropped out of school at 16 and moved to the financial capital Mumbai to find work in the city’s lucrative gem trade.

After a short stint in his brother’s plastics business, he launched the flagship family conglomerate that bears his name in 1988 by branching out into the export trade.

-AFP

Comments are closed, but trackbacks and pingbacks are open.