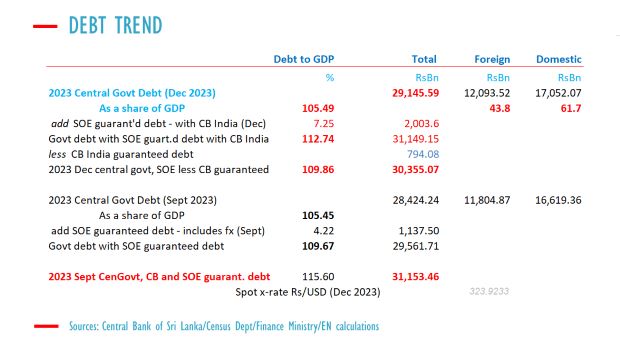

COLOMBO – Sri Lanka’s central government debt to gross domestic product was largely unchanged at 105.49% by December 2023, compared to 105.45% in September, but down from the end of 2022, an analysis of official data shows.

Central government local and foreign debt was reported at 29,145 billion rupees by December 2023, with the rupee at 323.92 to the US dollar, up from 28,424 billion in September 2023.

Rolling GDP for the four quarters ending in December 2023 was 27,629 trillion rupees, up from 26,636 billion to September as the economy started to recover.

Central government debt was at 115.2% of GDP on the same basis at the end of December 2022. The central bank reported central government debt at 113.8% of GDP by the end of 2022 without defaulted loans.

SOE guaranteed debt by the end of 2022 was about another 5.62% of GDP.

When government-guaranteed debt was added, the debt-to-GDP ratio went up to 112.74% of GDP in December from 109.67% in September.

The government-guaranteed debt increased with central bank borrowings from the Reserve Bank of India being given a Treasury guarantee added to the guaranteed debt.

However, the central bank’s external debt is balanced by government securities, which are already covered and backed by domestic debt.

When a flexible exchange rate (soft-pegged) central bank uses reserves for imports, whether borrowed or not, an equal amount of money is printed to suppress policy rates, through to the acquisition of government securities from banks through open market operations.

The securities on the asset side of the balance sheet, can be sold for dollars to repay the debt, as long as monetary stability is maintained by not injecting further liquidity through liquidity facilities to generate forex shortages.

Without central bank debt, the SOE guaranteed debt was at 109.86% of GDP in December, almost unchanged from 109.67% in September.

Sri Lanka’s budget deficit, which was about two trillion rupees by November 2023, adds to the debt-to-GDP ratio, while growth in nominal GDP reduces it.

Currency appreciation also tends to reduce dollar debt in domestic currency. The exchange rate was largely unchanged at 323.92 US dollars by December 2023, against 324.44 rupees used in September.

From January to March the rupee has been allowed to appreciate close to 304 to the US dollar amid deflationary policy.

Some of the dollar debt taken from multilateral lenders has been used to repay debt. The central bank’s negative net foreign asset position has also improved over the year amid deflationary policy, with some foreign borrowings being paid back.

Sri Lanka defaulted in 2022 after aggressive macroeconomic policy deployment involving inflationary rate cuts and tax cuts to boost growth (target potential output).

Macro-economists cut taxes and rates with central bank credit, after several years of revenue-based fiscal consolidation (abandoning cost cutting) and depreciating the currency instead of allowing rates to go up when private credit recovered (exchange rate as the first line of defence) triggered output shocks.

From around September 2022, the central bank has provided monetary stability to economic agents to work.

-economynext.com

Comments are closed, but trackbacks and pingbacks are open.